The B2B opportunity in LATAM

by Daniel Porras

Introduction:

E-commerce has become an essential part of the economy and the consumers. Since 2020, Latin America has seen increasing levels of online purchase penetration, pushed by the pandemic but also because of the increase in internet penetration in the region (~78%) and the increased smartphone adoption (~77%). This era of digitalization has made it easier for consumers to buy online, which in many cases results in a more convenient transaction that saves time and money.

However, this increased penetration of digital channels has been mainly seen on the B2C side, where the e-commerce share of total retail sales is between 7% and 10% in several countries in LATAM. However, when we see the B2B side, the penetration percentage is under 2%. When we see more developed regions, the penetration rates of online B2B transactions are 14% in the USA and between 32% to 42% in several Asian countries. The digitalization of the B2B transaction represents a massive opportunity in LATAM. For example, in Brazil, the B2B retail market is almost USD$1Trn larger than the B2C market.

The B2B market is a more complex one than the B2C. In many cases, B2B transactions require a higher level of support from a sales representative, a higher number of SKUs, or price negotiation processes. The decision-making process for a consumer buying a single unit differs from someone buying hundreds of that same product, which generates added complexities. For this reason, B2C platforms tend to be generalist and sell a wide variety of products, in contrast, B2B platforms tend to be vertical specific as each industry has specific needs. However, despite the challenges, there have been several successful global B2B E-commerce/marketplaces like Faire, Ula or Grub market. In Latin America, several B2B online players have started to emerge, and these types of startups have already attracted over USD$1.5Bn of funding, according to transactions registered by Pitchbook. Some of the most mature platforms in the space in LATAM are Frubana (USD$277M raised), Chiper (USD$78M raised), and Inventa (USD$80M raised), which have raised from funds like a16z, Founders Fund, and Tiger. There are also some interesting emerging players like Seeri and Mecanizou.

One of the key values offered by these B2B platforms is better prices for small and medium buyers as well as good availability and ease to make a purchase when compared to what they can get buying in B2C online platforms. Speaking to customers, we perceive that in the B2B market, many buyers still prefer human interaction and often place orders with an agent on WhatsApp rather than putting an order on a digital platform. B2B transactions involve many units and a higher AOV than B2C, so buyers are more cautious and prefer to know that someone at the other end is ready to answer in case support is needed. This is why, as the startup scale, a good team of “farmers” or customer success agents is required to maintain good retention rates. For this reason we believe there will be several winners in different verticals and find it hard to think that players like Amazon or Mercado Libre will win, as the B2B market is more complex, and each sector has different needs and higher levels of support require than this players can offer.

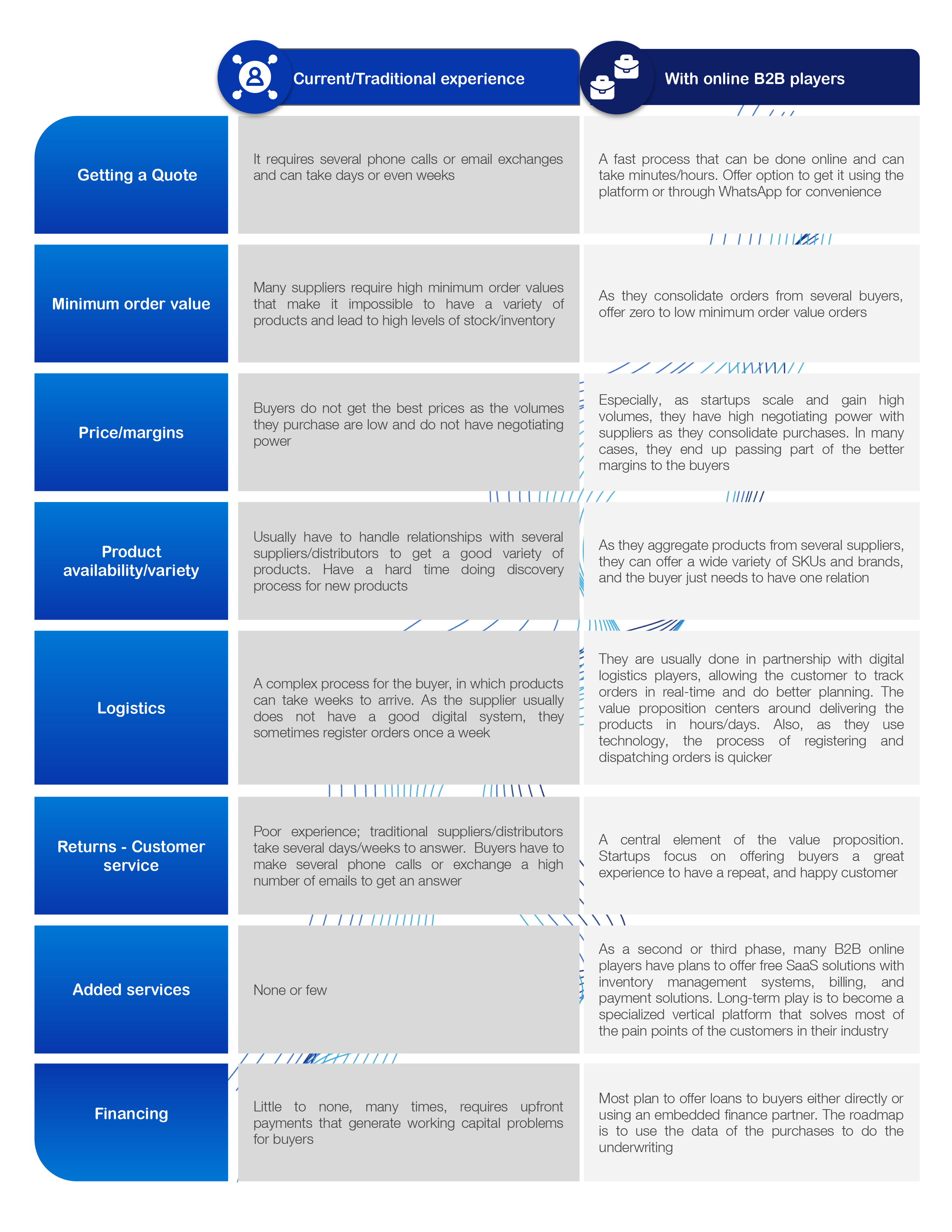

Paint Point/Value proposition for buyer:

In the past years at Dalus; we have been speaking with several emerging B2B online e-commerce/marketplace startups and their customers. Below, we will share some of the pain points we’ve discovered in the current way of doing this (“traditional way”) and how B2B startups are solving them

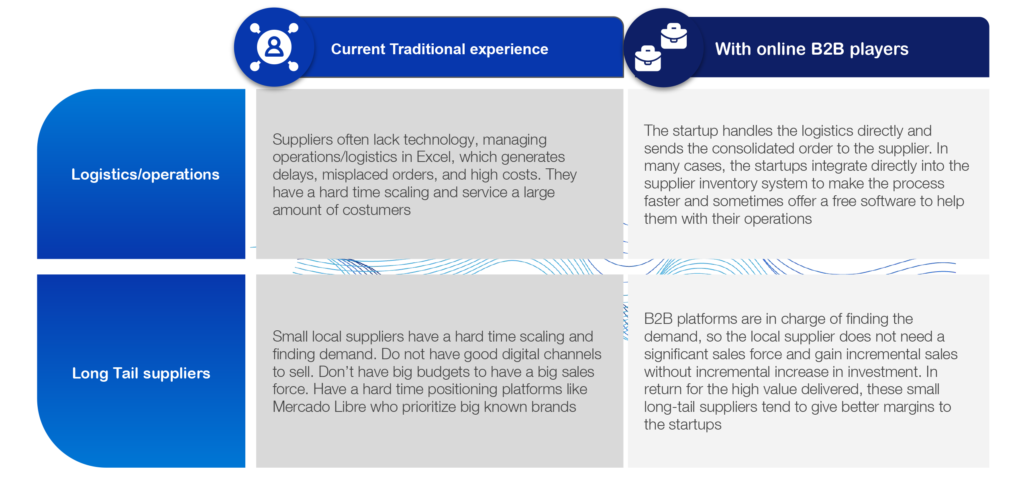

Paint Point/Value proposition for supplier/distributor:

The value delivered by these digital players benefits not only the buyers, but also the suppliers. Speaking with several suppliers/distributors, they don’t see these startups as competitors, but rather as sales channels that generate incremental sales without an incremental sales force investment. We do think that in the future/long-term that these digital players will replace existing distributors and some suppliers, but only upon reaching certain levels of scale.

Challenges of the model:

Economics

Beyond these current pain points, the e-commerce model faces many challenges that must be considered when evaluating an opportunity in the space. One of the most significant weaknesses we’ve seen from players we have spoken with is the tight margins that they operate with. It is common for these players to start with negative economics, as one of the main drivers is the take rate. When they begin as they handle low volumes, they have low negotiating power and are given low take rates that cannot support the logistic cost. However, as they scale, they tend to increase this take rate and, in some cases, can have more efficient operations to reduce logistics/operation costs and produce positive margins. Still, even when they can have positive margins different from a SaaS business where you can see margins up to 90%, B2B marketplaces/e-commerce platforms tend to show 3% – 15% margin levels, so they usually have higher capital requirements and higher expected dilution for the founders and early funds. This low margins and high level of capital requirements explain why these type of companies tend to be value at lower multiples than software companies, as reflected by this study made by Point9.

Operations/Logistics

Another big challenge of the model is the operations/logistics. There are two approaches to these platforms. One is asset-light, in which they connect buyers with suppliers but do not handle inventory and usually hire a third party for the logistics. In the second approach, they have warehouses with product inventory like Morado and, in many cases, have their own logistics fleet. Each model has its advantages and disadvantages. Asset-light ones require lower levels of investment and lower logistical complexity. Asset heavier models have the advantage that if they can have efficient operations, they can gain higher margins as they buy higher volumes for suppliers and are also able to deliver the product faster to the customers having a better customer experience. In any of these models, operational expertise is required in the team and is something that, at Dalus, we take a close look at when evaluating these businesses.

Product discovery

A third challenge that usually appears as the company scales is the product discovery process. As the company acquires more suppliers and SKUs, they have the complexity of showing the correct brand/product to the right buyer. You want to avoid seeing dependence on 1 or 2 suppliers, as it represents a high risk of them leaving and gives them high negotiating power. One strategy we have seen working is selling a known product as an entry strategy to build a relationship with the buyer, and as they gain confidence, they start offering products from more unknown brands. The key is making a great prediction model for matching the right product with the right store. In this sense, the recommendation we give is building a native application front the beginning that allows for more customization as it scale, it might be more expensive than using a third party pre-built page, but it saves money and time thinking long term. I recommend anyone building in the space to read the product strategy of Faire.

Metrics/KPIs:

One of the critical things we have seen is that B2B online players have some key metrics for which founders or investors should look out. Below, we will share some of them and give numbers that are good values based on our experience.

We recommend taking these numbers cautiously and looking for them as a whole. For example, we saw a startup raised by high-profile investors with a low AOV, which would lead to unfavorable economics in many cases. However, they had a cluster strategy, so they could have highly efficient logistics and reduced costs, making the model viable.

Final remarks

At Dalus, we are highly excited about the future of B2B marketplaces/e-commerce in the region and think this is just the beginning. We see great opportunities in several fragmented/traditional industries, like auto parts, trucking, beauty, wellness, freight, energy, agriculture, and construction. We get highly excited when we meet a company that has plans to make a vertical play and solve several pain points of a costumer, creating competitive advantages and making it hard for other players like MELI to compete with them. If you are a founder building something in the space, do not hesitate to reach out to info@daluscapital.com